Texas is known for having no state income tax. However, property taxes in Texas can vary widely across different counties and cities. There are several key reasons why your Texas property tax bill largely depends on where your home or property is located within the state.

Different County Appraisal Districts

Each county in Texas has its own appraisal district that is responsible for determining the market value of all properties within that county’s boundaries each year. While the Texas Comptroller’s office provides oversight and guidelines, the appraisal methodology and assessed values can differ substantially between counties.

Some counties are much more aggressive about increasing property appraisals each year compared to others. This means if you own two identical properties, your tax bill could be quite different based solely on which county each home falls into.

Varying Local Tax Rates

On top of the county’s appraised value of your property, local municipalities and other taxing entities like school districts each set their own property tax rates each year. While the statewide average property tax rate is around 2.18%, some areas of Texas have effective rates well above 3%.

So even if your home is appraised at the same dollar value as your neighbor’s house, if that home falls under different city, school district, or other jurisdiction boundaries, the actual tax bill on that property can be hundreds or thousands of dollars more or less due solely to the differences in local tax rates.

Housing Supply and Demand Imbalances

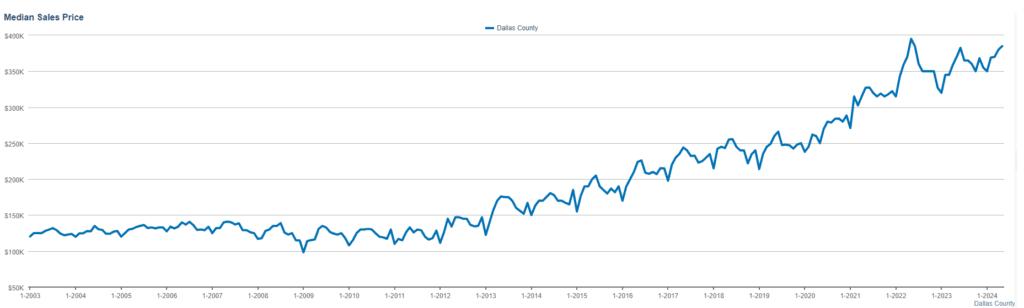

Property values are largely determined by market forces of supply and demand within a local real estate market. In many of Texas’ fastest growing metro areas like Austin and Dallas, housing demand has greatly outpaced new housing construction over the past decade.

When strong demand meets constrained supply, home prices and values escalate rapidly. This means property owners in booming areas of Texas often face double-digit percentage appraisal jumps and exponentially higher tax bills simply based on where they live within the state’s uneven real estate markets.

Varying Land, Improvement, and Homesite Values

Not all properties within a county have the same underlying land value or value of improvements/structures. For example, a home on a very large residential lot or estate parcel likely has much higher attributed land value than an identical home on a small suburban lot. Expensive custom homes or newer constructions also usually carry higher improvement values than older, more outdated properties.

Factors like waterfront access, golf course frontage, acreage, and more can dramatically alter the appraised homesite value the county assigns to your property. This further widens the discrepancies in tax bills between neighborhoods and locales within the same housing market.

Differing Agricultural and Open Space Exemptions

Texas has provisions that allow qualifying agricultural properties and open spaces to be appraised for property taxes at reduced values. However, the strict eligibility criteria, application requirements, and exemption percentage levels can vary between counties.

For example, Travis County is much more stringent on granting agricultural exemptions than neighboring Williamson or Hays counties. So identical ranch properties could have wildly different tax bills simply based on which county they are located in.

Final Words

While Texas prides itself on being a low-tax state overall, property tax burdens are far from equal across the state. Where exactly your home or land is situated can result in major differences in your annual property tax owed. This makes it extremely difficult for Texas residents and business owners to predict from year to year how much their property tax bills may change. And in many areas, rapidly rising tax bills are pricing Texans out of homes they have lived in for decades.